The US market continues to make new highs. QE is ended but interest rates remain low and the central bank suggests that they will continue low. Oil prices continue to fall and are now at levels not seen since 2010. The US economy continues to improve. All in all the situation appears to be set fair.

It is also the time of year when stock markets, on average, do best.

FTSE

The UK market has been doing well for a month but needs another 300 pints to break through its previous highs.

So, can we relax? I am fully invested but far from relaxed. I feel the need to make hay while the sun shines but I am watching the sky for the appearance of dark clouds.

To create my selection of UK shares I have reworked my analysis of the best Vector Vest Unisearches. My selection is a combination of standard searches, adaptations of the standard ones and ones that I have developed myself. I tested for the period November 1st to April 5th for each of the years 2008 to 2013. In those years, on average, the index moved up on average by 3.7% over that winter period. My shortlist of unisearches rose by between 5.5 and 26.5%. The standard unisearches that I tested were Southern Comfort UK which achieved 15.9%, SuperStars which made 15.8% and Hidden Gems which made 15.3%. Clear winners were, however, adaptations of Southern Comfort and SuperStars where I added conditions that picked shares that already showed significant momentum. These two searches yielded back-test performance over the past five years of 26.5% and 21%. The shares I picked using these tests are IAG, EMG, PHD, FLYB, INL, LMP, and TSTL. All, with the exception of LMP are proving winners with an average rise of 2.5% in the space of about a week.

Hard times on US market

I have had a torrid time with my US shares. I have had to pull out with serious losses from attempted campaigns in mid September and early and late October. No fun at all!

My latest campaign, which began at the turn of this month is doing better. Up by just over half a percent. I have chosen to buy large selections of shares in small quantities. (AA AAL AAPL ADHD AMZG BRIT BSX COP CVX EOX FTR GASL GDP GERN GILD HBAN HCBK HES LYB MNDO MSFT MU NSPH ORCL RFMD RPRX SLB SNSS WPRT ZAZA)

I have gone for US shares purchased using unisearches that have done well in tests for the November to April periods in the past six years. These are Jail Break - No Contra ETFs, AC's Percent Price Poppers - RT Asc, Blyar's Bottom Feeders/BMB, Russell 2000/RT, Rob's Raiders, S&P500 - Stop ASC all of which have yielded on average well over 30% returns. Even better was an adaptation of The Comeback Kids but this generates lists of very risky shares..

China

I hope that this time my timing is right. I also wonder whether I should revisit Chinese shares in the US market since the Chinese stocks seem to have staged a major break out.

So that is where I am now. I hope my instinct for believing in a good winter to spring period will stand me in good stead. I need some luck.

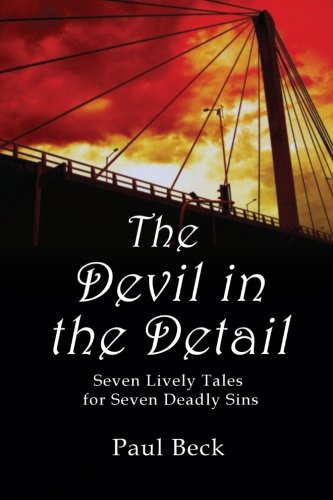

The Devil in the Detail

A couple of years ago I wrote a few short stories and I have decided to publish them. If you are interested they are available on Amazon under the title The Devil in the Detail.

in the US the link is Devil in the Detail

No comments:

Post a Comment