Oil

Enough of that. The big big news is that oil prices continue to plummet. My theory, and I have no evidence whatsoever, is that it is a concerted plan on the part of the top oil producers and their close allies. Objective: provide a boost for friendly economies around the world and attack and destroy three groups of competitors:

- First, the producers of alternative energies - wind, nuclear, solar, shale gas etc

- Second, oil producers with significantly higher marginal costs of oil extraction and excessive government expenditure that has been funded by good oil revenues

- Third, oil exploration companies

Reuters has just published the following table of marginal costs for producing oil:

Marginal cost of producing one new barrel of oil Regions Dollars per barrel ($/bbl) Arctic 115-122 Brazil Ethanol 63-69 Central and South America 29-35 Deepwater Offshore 54-60 EU Biodiesel 106-113 EU Ethanol 98-105 Middle East Onshore 10-17 North Sea 46-53 Oil Sands 89-96 Former Soviet Union Onshore 18-25 Russia Onshore 15-21 US Ethanol 80-87 US Shale Oil 70-77 WAF Offshore 38-44 (Reporting by Rowena Caine in London; Editing by Christopher Johnson and Dale Hudson)

With Brent Crude prices at $73 we can see that only three areas are not already in serious trouble: the Middle East which is mainly Saudi Arabia and the Gulf States; the former Soviet Union and Russia; and Central and South America.

Even some oil producers with low extraction costs are in trouble because their national budgets have been set on the assumption that they will be earning high excess revenues from good oil prices. Russia is included in this group of countries vulnerable to the effect of low oil prices. In 2010 46% of the government's revenues came from oil. The 40% fall in oil prices in the past six months will have had a devastating effect.

The strategy of driving down prices by the oil producers' big guns has a terrific logic. They have allowed their competitors to spend on research and development, almost always, funded by government subsidies only to come in at a crucial moment and show who really is boss: cheap oil.

Just wait. The climate change warriors will be shut out of the debate on future energy because the cost differential between their pet projects and cheap oil will be too great. No more wind farms, and the scourge of ugly solar panel will be over.

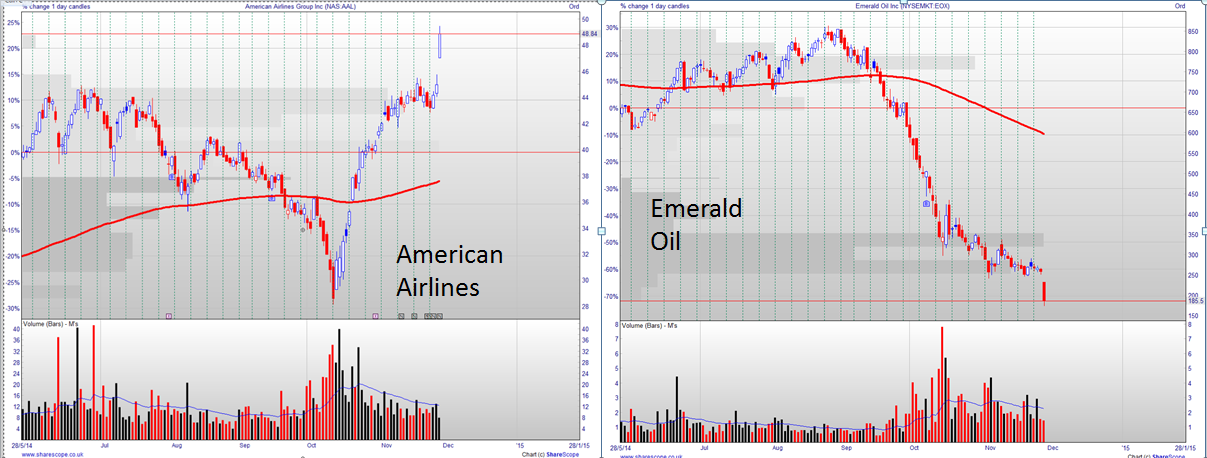

On the plus side cheap oil will help to keep the battered economies of the west afloat and China's cost base will be lowered. With luck the stock market will be buoyed by this unexpected cost saving bonus - better ditch those oil shares, especially exploration companies, and pile into aviation stocks.