http://www.metrolyrics.com/back-in-the-saddle-again-lyrics-gene-autry.html

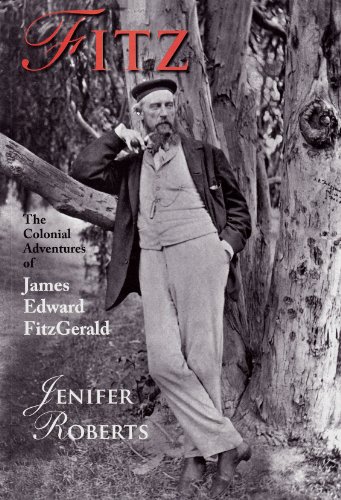

I am recovering from a 24hr plus plane journey. The trip was to launch my wife's new book

Fitz. It was a sparkling success. She has hit the New Zealand best seller lists, for this week at least. It is the biography of the first prime minister of New Zealand and is a rollocking read as attested by ordinary readers and reviewers alike.

So what has the market done while I have been away. I have not been watching as carefully as I should - a lot on my mind: things to see, places to go, people to meet.

I thought I was watching same old, same old: one day up, next day down. As it turns out new highs were hit on the US markets. The S&P arrived with a big fanfare at its first ever close above 1900 last night. It was up just under 2% since I went away with a large part of that coming in the past 4 days.

The Dow made its new all time high on the 13th of May but has since retreated. It is now up just over 1%.

My portfolio has done well over the period. It was buoyed by the Mr Market beginning to realise the virtues of GVC, and the cashing of a chunky quarterly dividend. Lest hope the market stays with it. There have been two items of news: planned expansion of activity in Scandinavia and in Malta. All paid for out of free cash flow it seems.

Net result is that my portfolio is up 2.5% since I left with just 23% of capital at risk. That means that the return on my invested portfolio was over 10% while I was away.

I now have two big jobs. To assess where the market is likely to go next. You are used to my pessimism by now so it will not surprise you to know that I am wary of all these new highs. And then the more tricky task of deciding if I should try to invest more or to continue to sit on the sidelines. I'll tell you what I decide later this week.

No comments:

Post a Comment