Never trust those guys at Google

I hope I'm not tempting fate, but I seem to be better. Temperature down, energy levels rising, just one more day of antibiotics. These Klaricid tablets are really something. I was told they were powerful and the bugs that were doing me harm seem to have been squashed. Unfortunately so have the ones that live happily in my gut with consequences I leave to your imagination. I have been dosing myself with Yakult and Actimel. It's a ritual I perform whenever I'm taking antibiotics. Don't know if it works but it makes me happy.

Enough of that. Monday I was feeling well enough to play around on my computer. I had nothing new to say so no point posting n the blog but I thought 'd play around anyway. "Try out our new templates," the Google guys who manager the Blogger network. So I did. I was rather incautious though, and missed the instruction about how you could save your old design and within seconds I had something new and there was no way to go back to the old. Never trust those guys at Google, they offer new stuff but don't provide an archive so you can go back. If you've never tried out these standard templates that can be found all over the internet, and not just by the big boys like Google, be very careful. They tend to be loud, overdecorated and messy and give little consideration for readability.

So there I was stuck. No way back and something rather ghastly instead. Customizing the least ghastly template took quite a while because the tools were far from intuitive. Still I did it in the end and think the new version is OK though not as stylish as the old. It has one big advantage: you can adjust the width of columns so I can now put in charts that offer an idea of what is going on at a glance without the need to enlarge them.

The charts looked quite anemic in this new, bigger guise, so I have had a go at brightening them up. I've also widened the left hand column so you can see the almost real-time intra-day charts more easily. These have adverts stuck at the bottom. Not my fault, that's how they come. Occasionally the ads move up to take the place of the charts. When you see this just scroll up and you'll find the charts again.

I'll be tweaking the design for some days, but I'm not too unhappy with how it looks now. As ever, creative criticism is invited.

And now the market

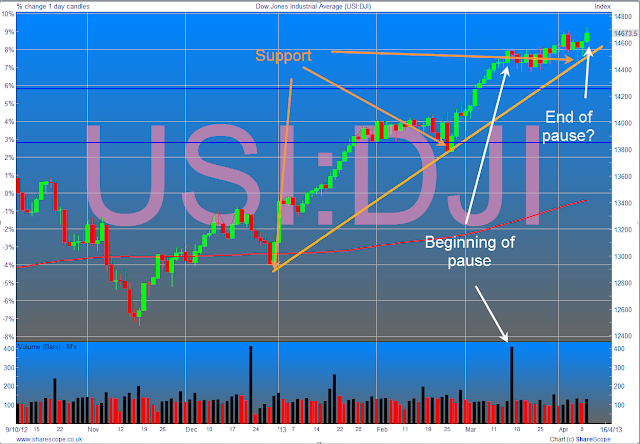

My instinct is that the market is too high. I thought that volume spike on 15th March signaled the end of the rally. It looks as though it simply marked a period of treading water.

There's no point in looking at these charts without noticing what they say. It now looks as though the bulls still have the edge. For almost four weeks we have been going nowhere. I'ts one day up and one day down. But since the 28th March there has been a noticeable shift upwards. Last Friday and Monday the day's action showed a recovery from a steep drop and, more importantly, the lows of each day respected a diagonal support line which originated on 31st December and held back an attempted correction on the 25th and 26th February.

I hesitate to call this analysis. It's more like reading the entrails of a chicken. But it has encouraged me to put a toe in the water yesterday. I bought just three US stocks. They are GTN HIMX and EVC. As ever you must not take this as a recommendation, it's my money and my risk. I understand how to take risks and know what to do if I turn out to be wrong. But I know I can be wrong so be warned.

And how are things in London?

The UK market has been hurting. It broke support on 21st March and a rally on 2nd April found that support had turned into resistance signalling the beginning of a viscous three day pull back. The last couple of days have seen a modest improvement.

What of gold?

After that nasty dip, gold is rallying again. I'm not making much so I'll pull out if necessary especially if I feel like buying more shares. I also need to watch that resistance line which is just 1.5% away. However you look at it, gold is not likely to make me rich any time soon.

No comments:

Post a Comment