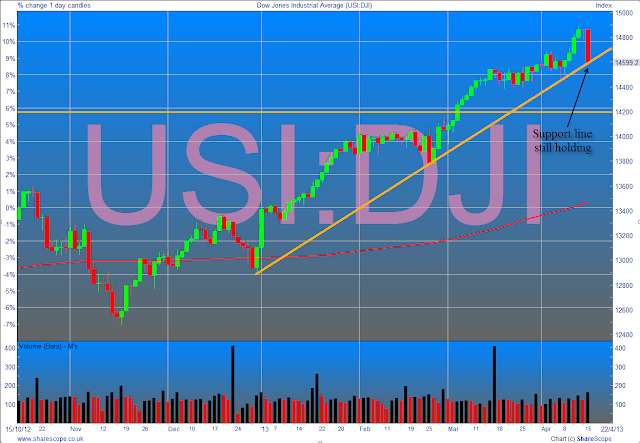

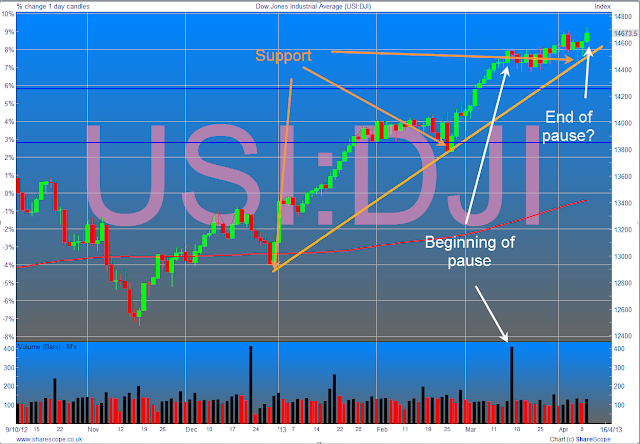

Looking at

the charts I begin to get the feeling this is not a change in direction but a

bump in the road. The DOW and the S&P have both arrived at their previous

all-time high and, not unexpectedly, they have taken a pause for breath. All

those doubters, including me, have thought to themselves “This is it boys, end

of the line,” and have dumped their holdings. But the bulls have been sitting

there keen to fill their boots with temporarily cheaper shares. Not so much

arriving at the buffers, more a case of negotiating a series of sets of points.

(I’m enjoying mixing my metaphors.)

If this new

view is right, then the bull market has further to run. If I was wrong before

and am right now what was it about my analysis that led me astray?

I've said

it before and I’ll say it again. All that cash the governments in the major

western economies are dishing out to the banks through QE has to cause inflation

somewhere. The market which is being inflated is the stock market.

But there

is something else which I have ignored: low interest rates. If interest on

bonds and deposits is close to zero and the dividend return on shares is much

higher (around 3% for the DOW for example) then the choice for investors with

cash becomes a no brainer. As long as you are buying solid companies with good

market franchises you can do much better investing in the stock market, even at

current levels, than keeping money on deposit.

For banks

it makes more sense to lend to stock market investors than to small businesses

who, in tough economic times, are bound to be vulnerable.

I plan to

research this idea a bit more thoroughly and will post shortly.

In the mean

time we need to keep a sharp eye on the pattern the market is making to see if

we have run into an enormous sleeping policeman or if we have reached the end

of the road.

Here, for a

change is the chart of the FTSE which shows a very interesting, lumpy picture.

What neuroscience is is telling us about consciousness

The

ravenous brain inside your head is bombarded, every waking moment, with a flood

of stimuli both internal and external. In order to cope with all this

information, the brain ravenously searches for patterns to condense information

into chunks that can be more efficiently absorbed and digested inside the

limited space available for conscious attention.

Daniel Borbegins his book about the latest discoveries in the new science of

consciousness with two anecdotes. He visits his father who has been struck down

by a stroke. If he sits on his father’s right side, the man he used to know is

aware of his presence and is able to converse, sort of. Sitting on his left,

his father is unaware of his son and behaves as if he was not there. The man looks

like his father but displays none of the personality or cognitive ability that

made him recognisable as the man he used to be. The stroke has damaged his brain,

breaking the neurological links that generated his ability to think and respond

in the manner which characterised his personality. Injure the brain and the

mind is crushed.

The second

anecdote describes Bor as the subject of an experiment. An MRI scan reveals that

imagining a physical activity, such as playing tennis, lights up one part of

the brain, while visualising places, such as home, activates a different section.

In the experiment, Bor is asked to imagine playing tennis when he wants to give

the answer no to questions and to visualise wandering around his house when he

wants to answer yes. The experimenter observes Bor’s brain activity on the MRI

monitor; he obtains Bor’s responses by looking into

his brain. He has no other

access for Bor does not speak. The experiment shows that observing the brain provides

direct access to the mind.

These two

anecdotes point to the conclusion that the brain, a physical, mechanical and

electrical entity, is identical with the mind.

The main thrust

of the book reveals what neuroscience is discovering about consciousness. Bor

began his academic studies in philosophy. He was well-versed in the philosophical

discussion about the separation between mind and body (or soul and body as

philosophers with a more theological bent might prefer). But suddenly, with the

powerful new tool of the MRI scanner, neuroscientists were making discoveries

which rendered those philosophical discussions void. Bor switched his studies from

philosophy to neuroscience.

In this

book, he sets out to describe what is now understood about human consciousness.

The brain is a complex mechanism that works by sending electrical messages from

one neuron to the next in vast cascades. The overwhelming majority of these

messages are passed subconsciously. The brain can be seen to be active without its

owner having any awareness of what is happening. It controls the day-to-day

bodily functions of breathing, moving etc. etc. and none of this normally forms

any part of conscious awareness. This is also true of skills that have been

acquired, such as driving a car or striking the ball with a golf club. All of

this happens outside a person’s consciousness.

The brain

is bombarded all its waking time by an array of sensory input from eyes, ears, nose,

body sensations, and so on. However, the brain is constrained because it cannot

hold more than about four items of information in its awareness at any one

time. It therefore has to select which items to bring to the fore. The four

items change constantly, and make up the ever changing stream of pictures that

is consciousness. The brain is exquisitely attuned to juggling and shuffling

the competing items of information and choosing which ones to present to the

attention. This process of choosing, like most of the brain’s activity, is

unconscious.

A second

strategy that the brain employs to cope with unwieldy volumes of information is

by “chunking.” It collects information which lies in the longer-term memory and

groups it to present composite pictures that can be drawn to the attention. The

brain shows exceptional skill in finding patterns and clues that allow it to

group information to generate a coherent whole which can fill one of those four

precious spots in the brain’s conscious attention. In this way, it can toss and

turn information and find new and ever more complex patterns. It is the

discovery of these patterns that has led to the rise of the human species, with

the ability to garner and manipulate the resources of the planet and create the

world as we know it.

An

intriguing section in the book addresses the question of whether we can

accurately discern consciousness in other animals. Another looks at research

which uses MRI technology to identify consciousness in comatose patients and

tries to forecast which ones are likely to recover at least a part of their

normal consciousness.

The sheer

complexity of the brain’s activities leaves it vulnerable to damage. Even in

its physically undamaged state, it is prone to malfunction. The glitches are

what we know as mental illness. Several conditions can be explained as breakdowns

in the consciousness process. Autism, Bor argues, is caused by the brain’s poor

control of an excessive amount of information presented to the conscious attention.

This explains why many people at the more functional end of the autistic

spectrum may have exceptional skills, despite being handicapped by the need to

limit the sheer quantity of information that assails them. Like more seriously

affected individuals, they withdraw from normal social contact and attempt to

create a world where they can control the stimuli which assail them. At the

same time they have access to greater numbers of stimuli which they can process

into patterns more effectively than the rest of us.

At the

other extreme, schizophrenics seem to suffer from a lowered awareness and find

it difficult to distinguish between information that originates inside their brains

and that which comes from sensory inputs. Their conscious attention is made

aware of information, for example voices which originate inside their heads,

and these inputs are construed as external. Acting on this belief results in the

often bizarre behaviour that characterises the disease.

Research

has shown that many brain malfunctions are associated with poor sleep patterns.

In addition to correcting sleeping disorders, research has shown that meditation

can be effective in improving the functioning of consciousness.

This is a

fascinating book which brings the reader up-to-date with the latest research in

this rapidly developing field of science. Bor’s use of anecdotes, and his

injections of personal experience, illuminate the hard facts that he presents. He

is a philosopher and a human being first, and this makes his review of the bald

scientific evidence all the more appealing.

More Kindling

A loyal

reader has pointed out that I am quite wrong about the Kindle. On the original

machine there is a “Back” button which does exactly what I described as missing

in my last post. You follow a link to the diagram or note and then press “back”

and it’s as though you’ve never been away. I’ve tried it out and it works.

Humble apologies, Kindle folk.

I’ve looked

for an equivalent function on the Kindle application on my iPad and my Android

phone. Here it works slightly differently. You press the link and are taken to

your diagram, and then you press the diagram title to be taken back. I’ve

discovered that this system is poorly implemented, with links often missing.

I have two

remaining bugbears:

·

complex

diagrams are totally mangled.

·

links

to notes in the Ravenous Brain do not exist, so going to the back to read about

the research which proved the points made in the text means that you are back

to square one. You have to reset the farthest point read by going onto the

Kindle management site.