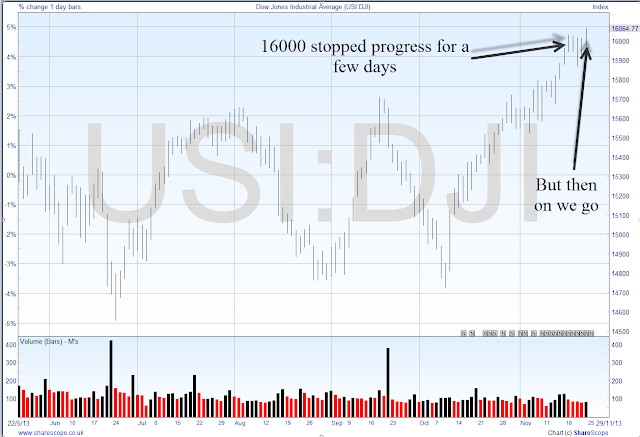

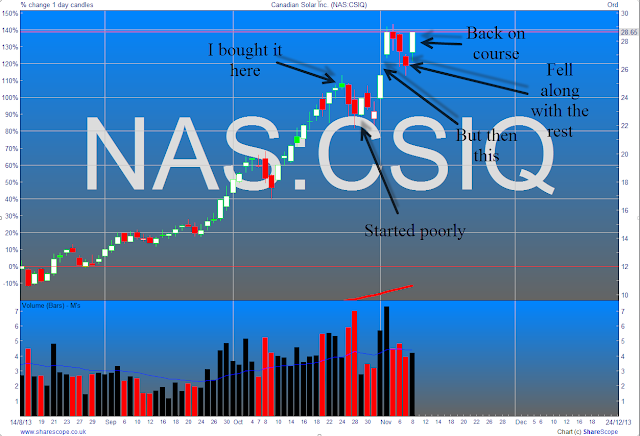

It's been a long wait but, at last, I can report that share picking has brought home the bacon. As always, I might be speaking too soon but the last three days have seen a dramatic turnaround. In those three days my 10 Chinese shares have put on an average of almost 14%. How did I pick them? It was that wonderful Vector Vest tool, the Simulator. I back-tested looking for picking methods that have worked well in the past few months when the DJI was making small new highs but suffered big pull backs. Regular readers will know it has not been smooth sailing, and there may still be storms ahead, but, at least for this morning, I will bask in the glow ofwhat those shares have achieved.

As ever tomorrow may bring disappointment. Chinese leaders have announced the direction of reform for the next decade. Markets were disappointed that the planned changes were not bolder and Chinese markets sank taking other Pacific markets with them. It loos as though the US market may also see another day of weakness. But we are at a cross roads. The market keeps banging it's head on a ceiling and no-one can say for sure whether it will break out or whether we are at the end of the bull run. I just have to take each day as it comes. Judging by thge performance of the FTSE so far, it is not coming well.

I have mentioned that I have been unwell for a couple of weeks now. Today seems to be a bit better but tomorrow I have another unpleasant medical procedure. But there has been one big advantage. I have been able to catch up with some some serious film watching. And I have seen some crackers.

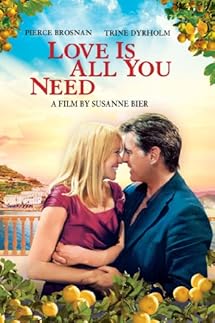

There was a beautiful Danish/English romantic comedy which started life with the title "The Bald Headed Hairdresser." It is now called "All You Need is Love." More appleaing to the US market I guess. It is a beautifully poignant piece. The charming and engaging main characters, played by Pierce Brosnan, Trine Dyrholm, battle their way through the mess that cliche insists surrounds any big family event, in this case a wedding in a fabulous lemon grove in Sicily.

Then there was Denzel Washington in a relentless attack on the evils of drink called "Flight." Not a film to be watched if you are going by air any time soon. But a thrilling couple of hours all the same.

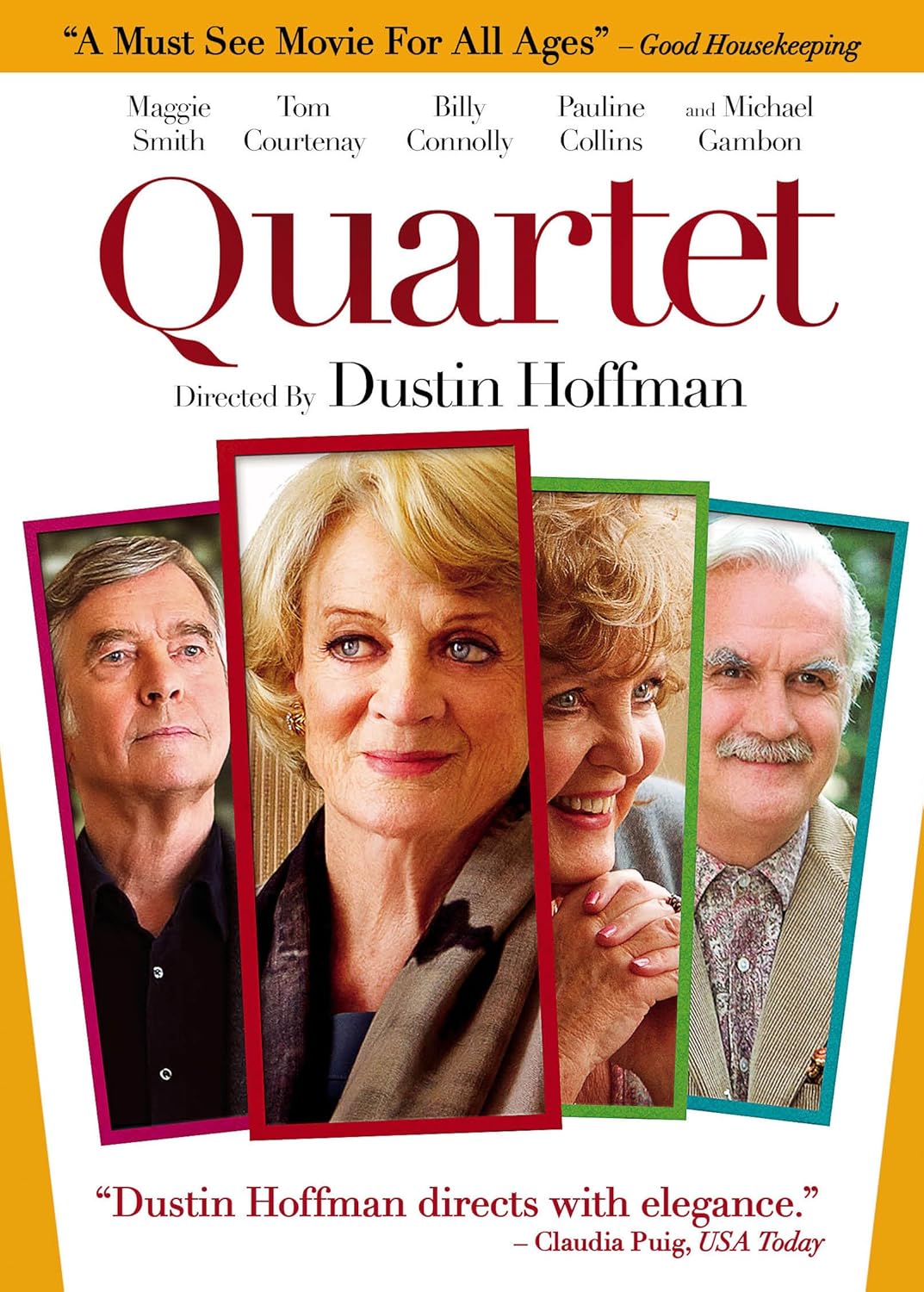

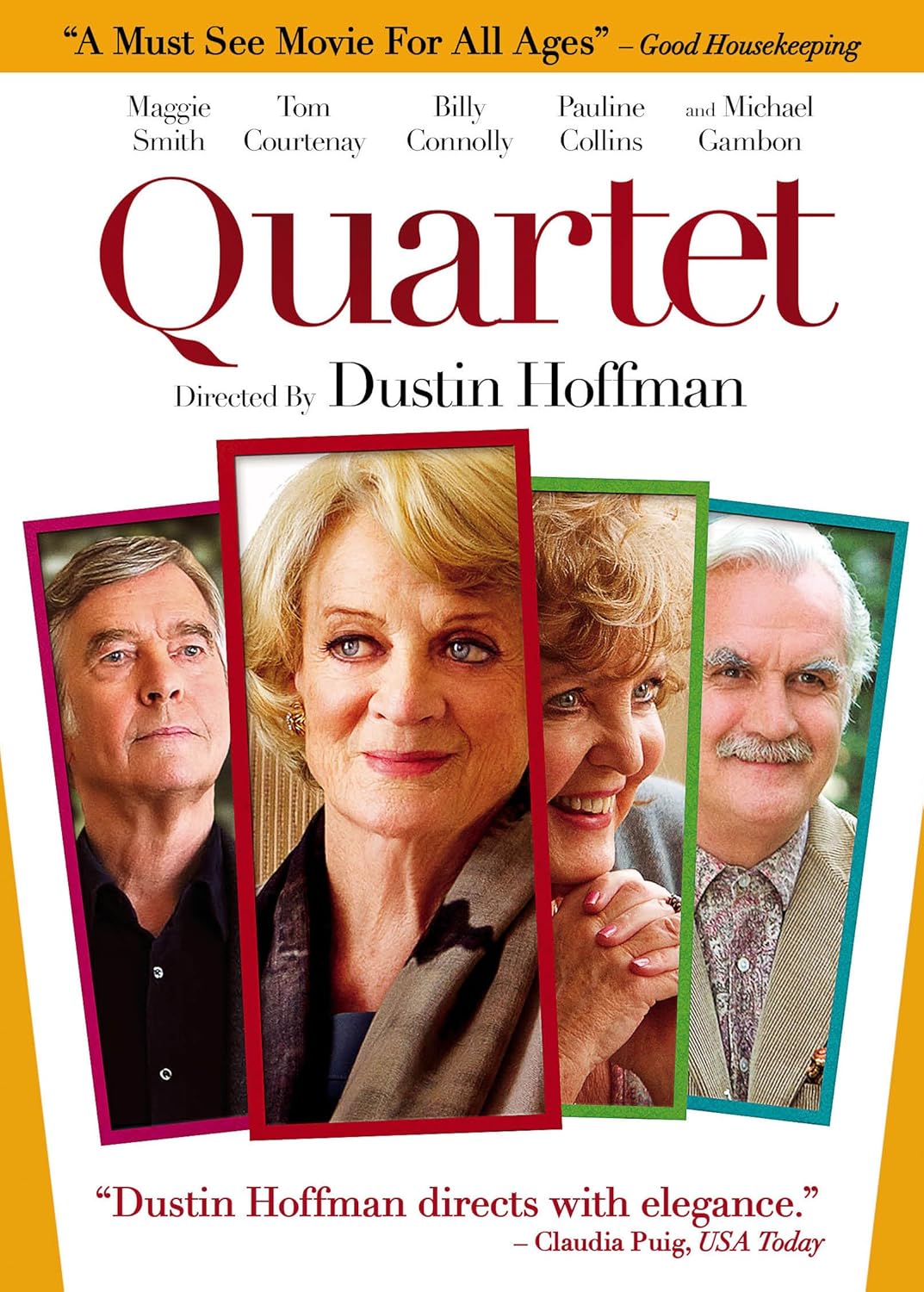

Another charming piece of romantic frippery was "Quartet". Set in a home for aging musicians it has the theme: it's never too late. It's main claim to fame are sparkling performances by Michael Gambon, Maggie Smith, Billy Connoly, Pauline Collins and a slightly stuffy Tom Courtney.

"Hichcock" starring Anthony Hopkins and Helen Mirren does not avoid the unpleasant sides of Hitchcock's character but flits over them lightly. It concentrates on the relationship between the man and his wife Alma. It acknowledges, as he did, that she was indispensable to his success. Helen Mirren's performance makes it abundantly clear that making her mark could only come from a woman who was a match for his strength of character.The story focuses on the making of Psycho and ends with a him explaining how difficult it was for him to choose new material. There is a very witty allusion to his next film which mirrors the way Hitch would capture the imagination.

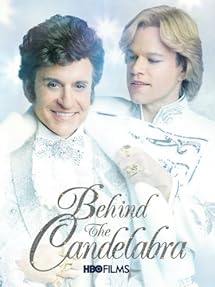

Then there are a few less happy choices. Worst was "Behind the Candelabra." Michael Douglas and Matt Damon fail miserably to capture the gay passion of Liberace and his young lover. The contrast with Sean Penn's performance in "Milk" could not be more stark. Candelabra shows no chemistry between the two. Instead you have two heterosexual actors struggling to play gay. Douglas does the camp thing, not hard given the Liberace trappings and Damon being nasty and greedy. There's no love here. Penn by contrast in the earlier film shows how passion can blind a lover to his objects manifest weaknesses. Oh what a waste was "Candelabra."

"The Reluctant Fundamentalist" loses all the ambiguity of the book. Instead of a subtle exploration of a very difficult subject, the movie resorts to the sledgehammer. All is black and white as is the wont of Hollywood and the American view of the world. A pity, for the film is made and played well.

Not so bad but extremely weak was "A Late Quartet." Another film about age and decline. It also harks back to some of the themes of "All you need is Love." If you pull out one brick in a structure the whole edifice may crumble. In this film the maker cannot be bothered to provide a believable resolution. It jumps from catastrophe to a new beginning without filling in the blanks.

And finally there was the latest Star Trek movie. New actors play the old crew. It is exciting but that's all you can say.